The Best Strategy To Use For Hard Money Atlanta

Wiki Article

The Buzz on Hard Money Atlanta

Table of Contents3 Simple Techniques For Hard Money AtlantaAn Unbiased View of Hard Money AtlantaWhat Does Hard Money Atlanta Mean?A Biased View of Hard Money AtlantaA Biased View of Hard Money AtlantaSome Ideas on Hard Money Atlanta You Need To Know

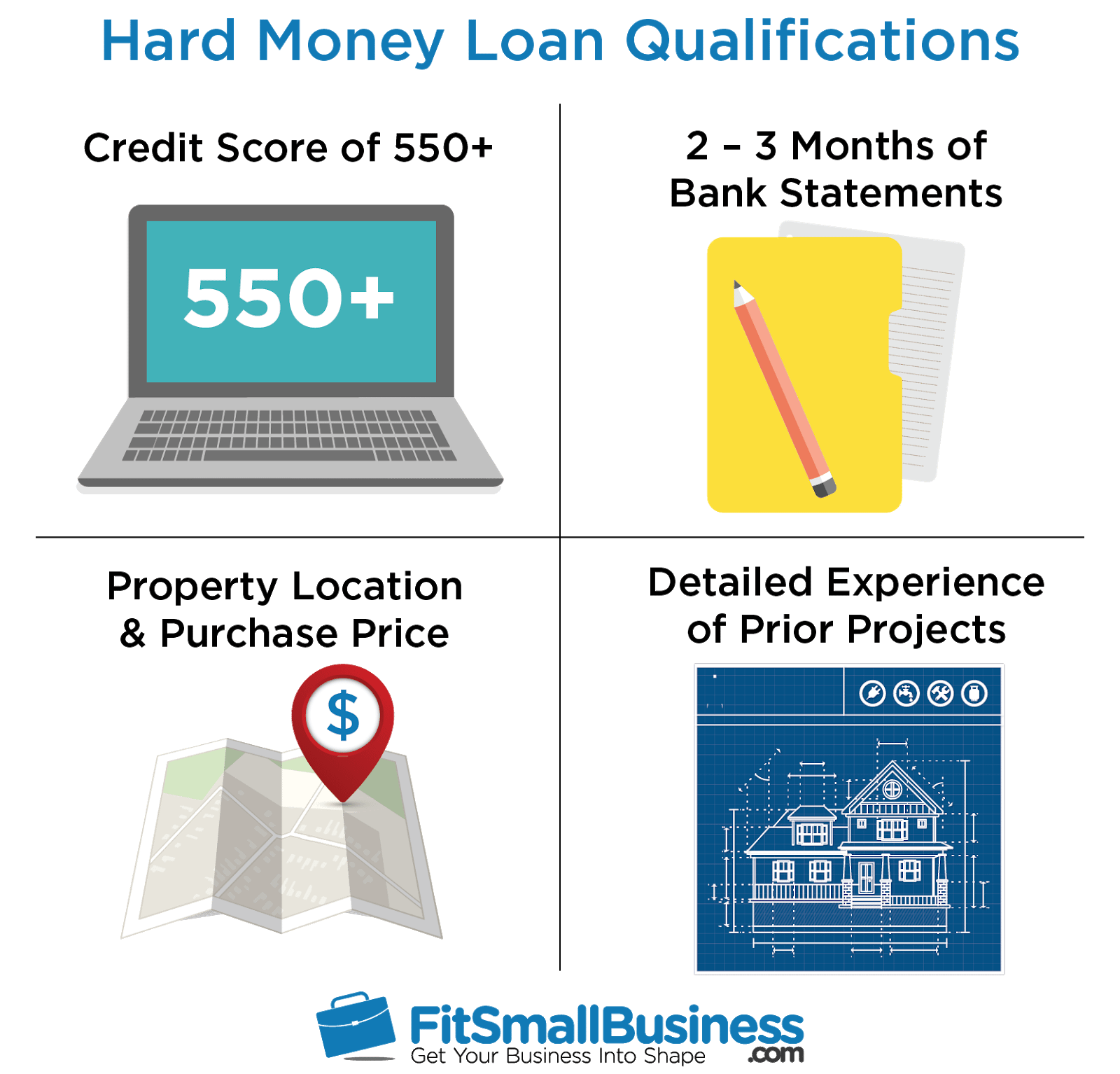

A tough money car loan is just a temporary financing secured by realty. They are moneyed by (or a fund of financiers) in contrast to traditional lenders such as banks or credit score unions. The terms are typically around one year, but the finance term can be included longer terms of 2-5 years.The amount the tough money lending institutions have the ability to offer to the debtor is largely based upon the worth of the subject property. The building may be one the customer already owns and wishes to utilize as collateral or it may be the residential or commercial property the customer is obtaining. Difficult money loan providers are mainly concerned with the instead than the debtor's credit report (although credit history is still of some value to the lending institution).

When the financial institutions say "No", the hard cash lending institutions can still state "Yes". A consumer can get a difficult cash car loan on nearly any type of kind of property including single-family domestic, multi-family household, commercial, land, as well as industrial. Some hard cash loan providers may concentrate on one particular building kind such as residential and not have the ability to do land car loans, merely because they have no experience in this field.

Get This Report on Hard Money Atlanta

Tough cash finances are suitable for circumstances such as: Land Loans Construction Loans When the Purchaser has credit score issues. The major reason is the capability of the difficult cash lending institution to fund the finance promptly.

Contrast that to the 30 45 days it takes to obtain a bank funding funded. The application process for a tough money car loan usually takes a day or 2 as well as in some instances, a loan can be authorized the very same day.

Hard Money Atlanta for Beginners

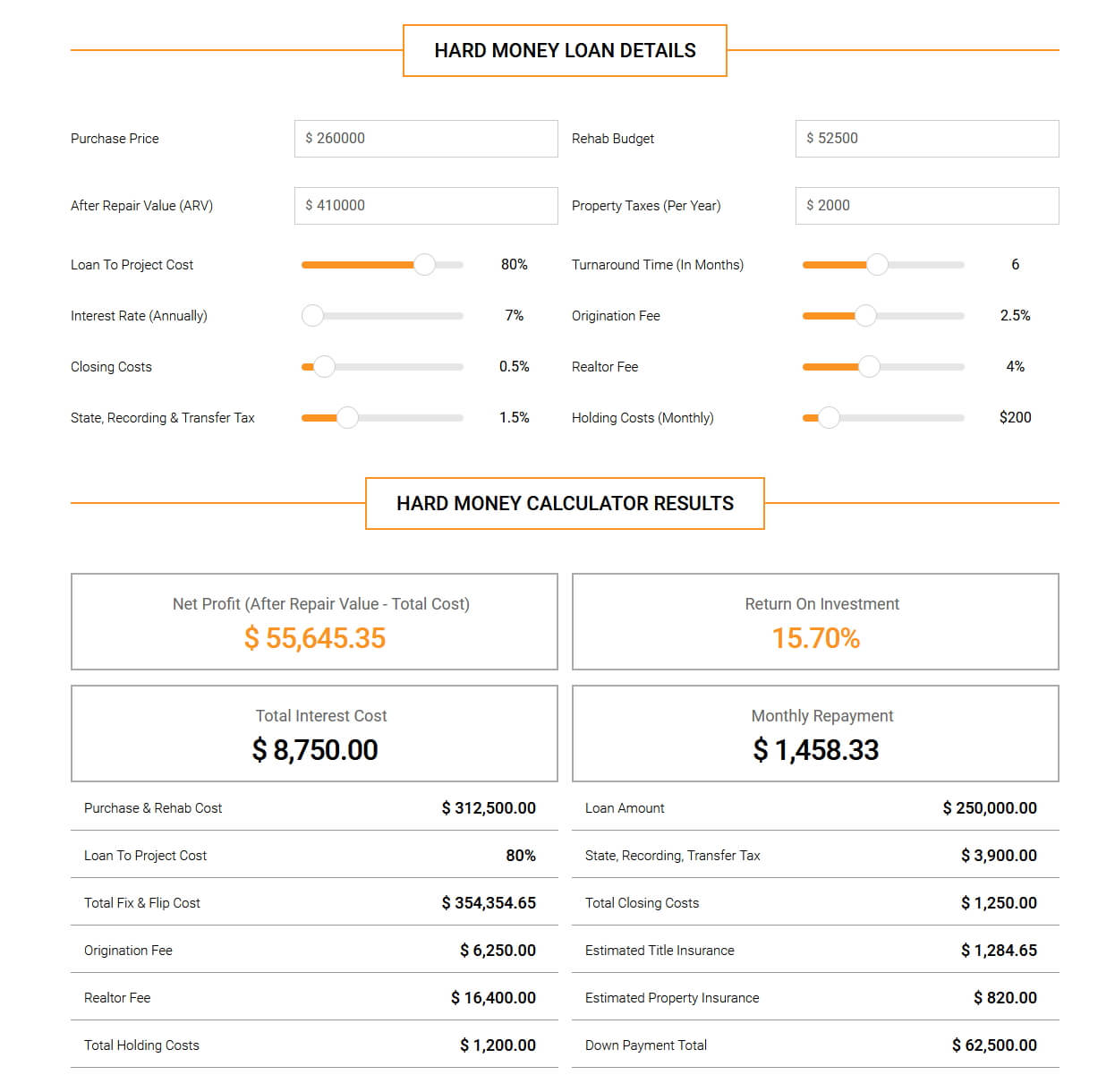

The interest prices and also points charged by difficult money lending institutions will certainly differ from loan provider to loan provider and will certainly additionally vary from region to area. Tough money loan providers in The golden state usually have reduced rates than other components of the nation considering that California has numerous tough cash providing companies. Boosted competitors leads to a decline in prices.Due to this higher risk entailed on a difficult cash lending, the rates of interest for a hard money lending will certainly be greater than standard fundings. Rate of interest for hard money financings range from 10 15% depending upon the details lender as well as the viewed risk of the loan. Points can vary anywhere from 2 4% of the total amount loaned.

The lending amount the hard cash loan provider is able to lend is figured out by the ratio of the financing amount split by the value of a residential property. This is understood as the car loan to worth (LTV). Many difficult cash lending institutions will provide up to 65 75% of the present value of the home.

Facts About Hard Money Atlanta Revealed

This produces a riskier lending from the difficult look what i found cash lending institution's perspective since the quantity of resources placed in by the lending institution increases and also the quantity of resources spent by the customer lowers. This raised threat will trigger a tough cash lender to charge a greater rates of interest - hard money atlanta. There are some difficult cash lending institutions that will provide a high percent of the ARV as well as will also fund the rehab costs.Anticipate 15 18% rate of interest and also 5 6 factors when a lender funds a car loan with little to no down repayment from the customer (hard money atlanta). In some situations, it may be worthwhile for the borrower to pay these excessively high rates in order to secure the bargain if they can still create profit from the project.

They are less worried about the debtor's Visit Website credit score rating. Problems on a borrower's document such as a repossession or short sale can be ignored if the consumer has the capital to pay the passion on the loan. The tough cash lending institution must also think about the customer's strategy for the residential or commercial property.

6 Simple Techniques For Hard Money Atlanta

One more method to find a hard cash loan provider is by attending your local investor club meeting. These club conferences exist in many cities and also are typically well-attended why not try here by difficult money loan providers aiming to network with possible consumers. If no tough money lending institutions are present at the conference, ask other investor if they have a tough money loan provider they can suggest.

How do tough cash finances function? Is a difficult cash funding appropriate for your scenario? Today, we'll answer these concerns, offering you the malfunction of hard cash financings.

The 3-Minute Rule for Hard Money Atlanta

With standard loan alternatives, the lender, such as a financial institution or cooperative credit union, will certainly check out your credit score as well as validate your revenue to identify whether you can pay off the car loan. On the other hand, with a difficult cash car loan, you obtain cash from a personal loan provider or individual, as well as their decision to lend will concentrate on the quality of the property.

Report this wiki page